DALLAS — Recently as I was becoming a Texas real estate agent, I left sticky notes in my books for the things real estate agents must know that we should probably all know.

So, here’s another lesson in my series of reports called "Home Schooling."

Benefits of homesteads

Texas homeowners: A reminder sticky note for you. Actually, a bunch of them.

If you don’t have a homestead, apply for it! Click here for a homestead application.

You may already have it. You can check whether you already do by finding your address on your central appraisal district (CAD) website and looking under exemptions. Click here to find links to all CADs in Texas.

Real estate professionals learn a lot about homesteads, because those legally prevent most creditors from forcing the sale of your home to pay your debts. A homestead also comes with exemptions that give you a big financial break every year on your property taxes.

An exemption takes away a chunk of your home’s value and exempts it from property taxes. We pay some of the highest property taxes in the country

Current exemptions

In 2023, Texas lawmakers passed a property tax relief bill that was signed into law by the governor. That legislation significantly increased the amount of a homestead's value that is exempt from school taxes. The exemption went from at least $40,000 to at least $100,000.

So, let’s say your home is appraised at $400,000. That $100,000 exemption is applied, and your school property taxes are calculated as though your home is valued at $300,000.

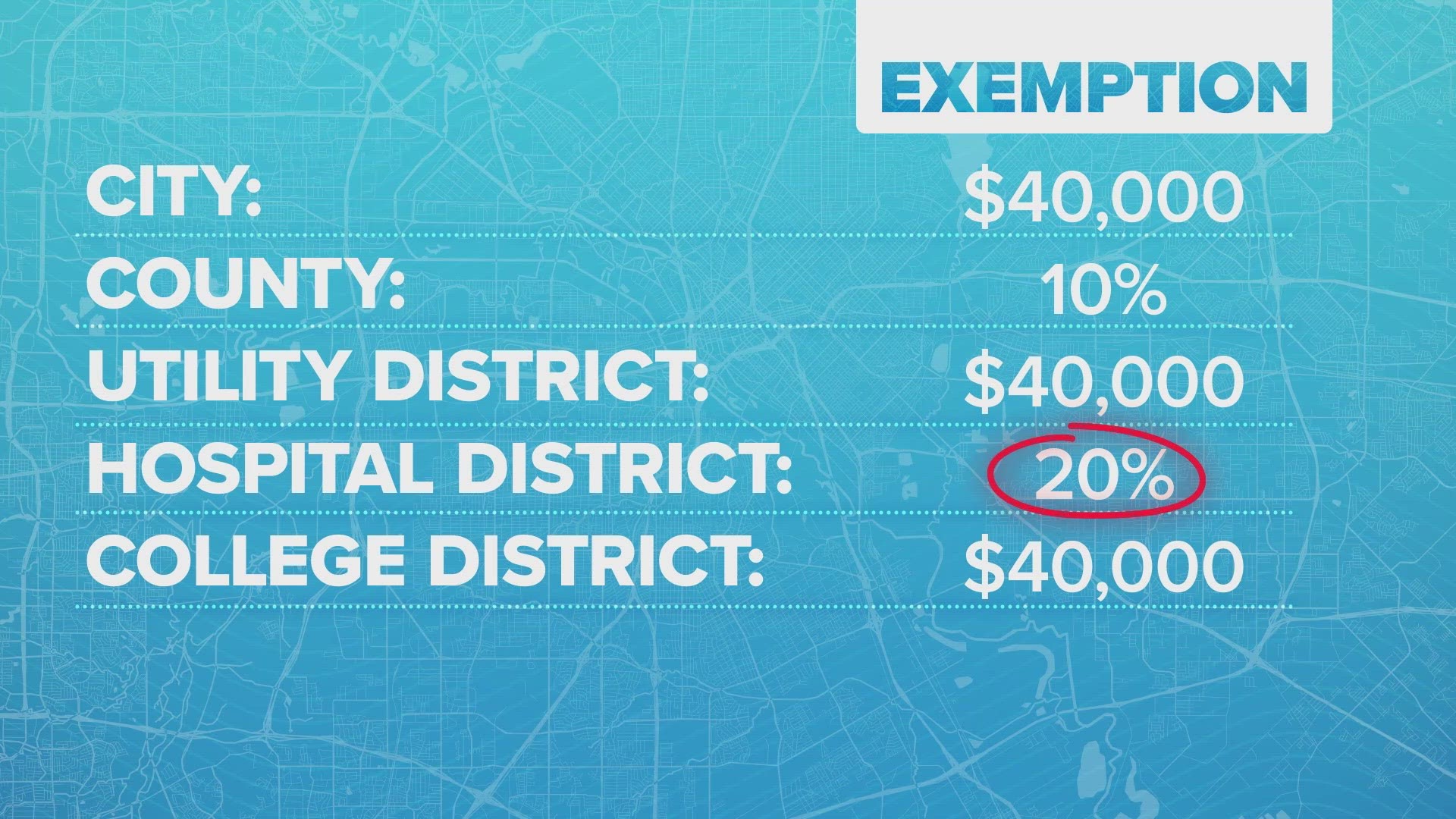

Your county and city and other tax authorities will want their cut of property taxes, too. Many of them offer exemptions as a flat amount.

For instance, they might knock $40,000 off your value before determining their portion of your property tax bill. Or they can take as much as 20% off your home’s value before they do the math. If a taxing entity offers a 20% homestead exemption, that would mean a $400,000 home would get an $80,000 exemption and would be taxed as though it’s a $320,000 home.

Exemptions can differ between different cities, counties, school districts, and college, hospital, and utility districts. If you are shopping for a home, compare the taxing entities, their tax rates and their homestead exemptions for the different properties.

There may be substantially different tax burdens from one property to another.

On-time and late homestead applications

If you bought a home in the last year, apply for your homestead before April 30 in order for it to apply to this year’s property taxes. If you bought years ago and didn’t apply for a homestead because your reminder sticky note fell, you can apply late.

Exemptions can be applied retroactively, meaning you may be able to recoup the property taxes you paid on the portion of your property that would’ve been exempted if you had applied for your exemption on time.

The whole retroactive thing can be a little confusing. Maybe this helps. Usually you receive your appraisal in April or May. There is a roughly one-month period when appraisal protests are considered. Then, taxing authorities set their budgets and their tax rates in the months that follow, and you receive your property tax bill by the end of the year. Generally, by the beginning of February of the following year, that property tax bill is delinquent if you haven't paid it yet.

With that in mind, this is what the Texas Comptroller's office says about late homestead exemptions, "A late residence homestead exemption application…may be filed up to two years after the delinquency date, which is usually Feb. 1." It can also be January 31st.

The Collin Central Appraisal District was kind enough to pass along a couple of examples on how your homestead exemption would apply retroactively:

- If the homeowner bought the residence in 2020, then they can apply for a homestead and be eligible for the exemption for tax years 2021 and 2022 if they apply before April 30, 2023.

- If the homeowner bought the residence in 2019, and they apply for the exemption before April 30, 2023, they are eligible for tax year 2021 only because the 2020 tax year would be more than two years before the January 31, 2023 delinquency date.

Again, assuming that the delinquency date for your 2020 property taxes is January 31, 2021, you would have two years after that delinquency date to file for a late homestead exemption. But if you didn't file that late application until after January 31, 2021...let's say you filed it on February 15, 2021...now the only previous tax year you can qualify for a retroactive homestead is 2021.

Extra perks for homeowners who are 65+ or are disabled

There are extra exemptions for homeowners who are disabled or are 65 and older.

An example: Last year, Dallas County, which already gives a standard homestead exemption of 20% of your home’s value, took off an additional $100,000 if you were disabled or over 65.

So, if your home was valued at $350,000, the county taxed it as though it was valued at just $180,000. For 65+ and disabled homeowners, extra exemptions like that can also be offered by other taxing entities, like your city, hospital, college and utility districts.

For school taxes, there’s the standard $40,000 subtracted from a homestead value before the district calculates its portion of property taxes. For disabled and 65+ homeowners, school districts take off an additional $10,000.

But they have the option of exempting even more. Dallas ISD last year subtracted an additional $45,000 of value for those groups. Also, for these groups of homeowners, school taxes can’t keep rising. They freeze if you don’t improve your home beyond maintenance and repairs.

A final note: Homeowners who are disabled or over 65 can legally stop paying property taxes. Instead, they can defer them until they die or the home is no longer their primary residence. Only then would the deferred taxes and annual interest come due.

There’s more information on that here, courtesy of Denton County. If someone who wants to exercise that option still owes on a mortgage, they will need to check with their lender. The lender may not agree to let them defer their taxes.