CELINA, Texas — A 76-year-old Army veteran and former Dallas firefighter has unretired and is now driving a rock truck twice a week in Collin County to pay off a skyrocketing property tax bill for a meager piece of land in Celina that is too sentimental for him to let go.

It's the dark side of the real estate boom in North Texas -- first showing up to Billy Pell's door in 2022. Pell gets straight to the point when you talk to him.

He puts his whole situation, a 144% value increase on a 50-foot by 198-foot wide plot of land from 2022 to 2023, pretty plainly.

"It's not that big, but they act like there's gold on it," Pell said. "They didn't like the tax collector in Jesus' day and still don't like him."

Pell has lived in Celina all his life. He was drafted in 1966 to serve in the Vietnam War and commuted to the big city to work for Dallas Fire Rescue for 32 years after coming home. He was also a volunteer firefighter in Celina during that tenure.

The small piece of land sits between Main and Elm in Celina -- the lot has no utilities or worthwhile structures, but a lot of memories.

It's been in Pell's family for decades, a piece of land he inherited. It's where his grandmother's apartment, built by his father, once stood. Pell's earliest memories of running around in the neighborhood playing 'kick the can' with friends are still fresh.

"This is where we as kids would come and watch 'Gunsmoke' and wrestling," Pell said. "If I got rid of this -- I would be letting my family down."

Because the piece of land is not Pell's home, he can't flex a homestead exemption that would drop $40,000 from his appraised value. That number has grown to $100,000 due to Proposition 4, which voters approved in November.

He also doesn't benefit from a 10% cap on a homeowner's newly appraised value from the preceding year.

There is some relief under Proposition 4 for Pell: Owners of commercial and residential properties that don't receive a homestead exemption will have a 20% cap on their value growth each year for the next three years if they are under $5 million.

Pell said he wishes that relief had come sooner.

$7,200 to $132,000

In 2021, Pell's plot was worth just $7,200. He paid just $160 bucks in taxes. In 2022, the property's value increased to $54,000. In 2023, Pell's jaw hit the floor when the appraised value came in at $132,000.

The Collin County Central Appraisal District explained to WFAA that the value of Pell's plot is a true reflection of rising property values in Collin County -- but there's little protection for him since the property isn't where Pell resides.

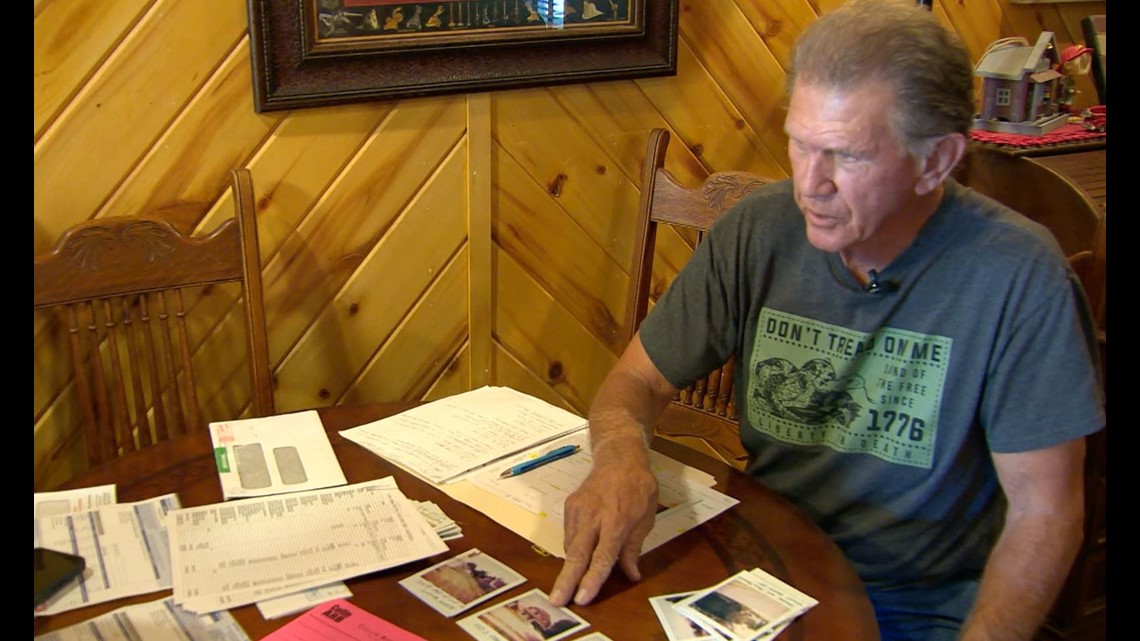

Pell disagrees with the first part of the above sentence — several plots and homes around where Pell lives were looked at to reach his current valuation. He went to each one, took photographs and notes, and pulled their valuations for the previous years.

One comparable property was brand new, two stories and across from an elementary school. Another lot was empty, with a slab ready for a new build across from the elementary school.

"It's not fair...it's not fair at all. There's no way you can compare a vacant lot with no utilities to a new house," Pell said.

Another property was in front of Celina's newly planned library and administration buildings.

For the first time, Pell protested his property tax bill, and wasn't alone.

Appraisal Protests up 15%

Per the Collin County CAD, 114,391 people protested their appraisals in 2023, a 15% jump from 2022, which was 98,977.

It's a 44% increase from 2021, which saw just 79,433 appraisals.

Pell is now entering mediation with the county about his property. He should know more after a meeting in January next year.

If Pell hadn't protested and left the value of his property alone, he would be required to pay roughly $3,500 a year in taxes. That's quite a jump from $160.

He says he's on a fixed income, going to doctors' appointments, and doesn't have the cash to afford that kind of increase.

WFAA followed Pell during one of the days he drives, and he said the job isn't easy at his age.

"Getting up in the driver's seat is like climbing a ladder," Pell said. "I never get out of this thing. I'm in it all day, and it's hard on you. It wears on you. I mean, how many years do I have left at 76? I want to spend my remaining years in peace without worrying about everything."

"It's not fair -- they don't care if somebody is on a fixed income. I'll have to keep working until I can't work anymore," he said. "You do what you have to do."

Pell said he isn't interested in selling the land, either.

"It's one thing to want to get rid of it because you want to; it's another because they're forcing you to because you can't pay the taxes," Pell said.

Ironically, several in Pell's family were in construction. They encouraged him to follow in their footsteps, but Pell went in a different direction.

Now, to preserve their memories, he's turned to the industry.

"Am I ever going to quit? Yeah. Probably when they put me in the ground," Pell said. "Everyone I know in Celina is in the cemetery--all I have now is memories. So yeah, I'll drive a rock truck."